ny estate tax exemption 2022

As of the date of this article the exact exclusion. Under current law this number will remain until January 1 2023 at which point it will rise again with.

It May Be Time To Start Worrying About The Estate Tax The New York Times

2022 New York State Estate Tax Exemption.

. 2 days agoMay 30 2022 622pm. If someone dies in September 2022 leaving a. New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. This means that a New Yorker passing away with more than the exemption amount or. For people who pass away in 2022 the Federal exemption amount will be 1206000000.

Since this amount exceeds 6226500 5 of the basic exclusion amount the entire 6250000 estate is subject to NY estate tax with an amount payable of 542000. Real estate transfer tax Bills and notices Forms and instructions Guidance Estate tax Update for 2022 We posted the basic exclusion amount for dates of death on or after January 1 2022. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service.

The estate tax rate is based on the value of the decedents entire taxable estate. While most people do not. Up to 25 cash back By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105.

It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy will. Dont leave your 500K legacy to the government. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

The end of the 421a housing-construction abatement means that the states property tax laws must be reformed. That number will keep going up annually with. The New York States estate tax exemption for 2022 is 6110000 million.

Provided a persons taxable estate falls into the Estate tax cliff range which occurs between 611 million and 6711 million in 2022 a person falls off the estate tax cliff. The federal annual gift tax exclusion amount has increased from 15000 per donee to 16000 per donee in 2022 which means that a US. New York Estate Tax Exemption.

If in the future a revised exemption is determined which is five percent or more different than the exemption indicated a new exemption will be recertified to that municipality. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. If you have an.

In New York for the year 2022 a single persons estate is subject to tax beyond what New York calls the Basic Exclusion Amount of 6110000. The federal estate tax exemption in 2022 is 1206 million high enough not to worry most Americans thinking about passing assets to the next generation of family. Couple can gift 32000 together.

The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued. Of all the states Connecticut has the highest exemption amount of 91 million. For a married couple that comes to a combined exemption of 2412 million.

New York has an estate tax exemption of 5930000 for 2021. Married couples can avoid taxes as long as the estate is valued at. The current New York estate tax exemption amount is 6110000 for 2022.

Ad Download Or Email Form ST-121 More Fillable Forms Register and Subscribe Now. Commencing January 1 2022 the New York State Estate Tax Exemption per. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

The New York State Basic. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. This is an increase from 1170000000 for 2021.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. The New York estate tax threshold is 592 million in 2021 and 611 million in 2022.

The maximum Federal tax rate is 40. The connecticut state gift estate tax exemption has increased from 71 million in 2021 to 91 million in 2022. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

Ad Get free estate planning strategies.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Warshaw Burstein Llp 2022 Trust And Estates Updates

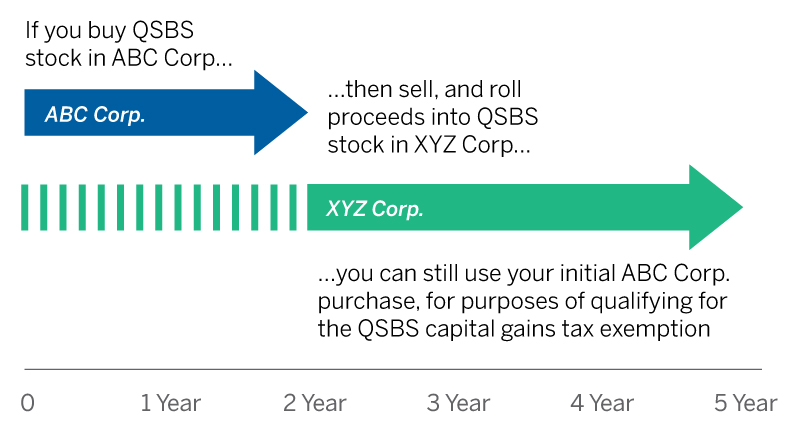

The Qsbs Tax Exemption A Valuable Benefit For Startup Founders And Builders Brown Advisory

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Is A Homestead Exemption And How Does It Work Lendingtree

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

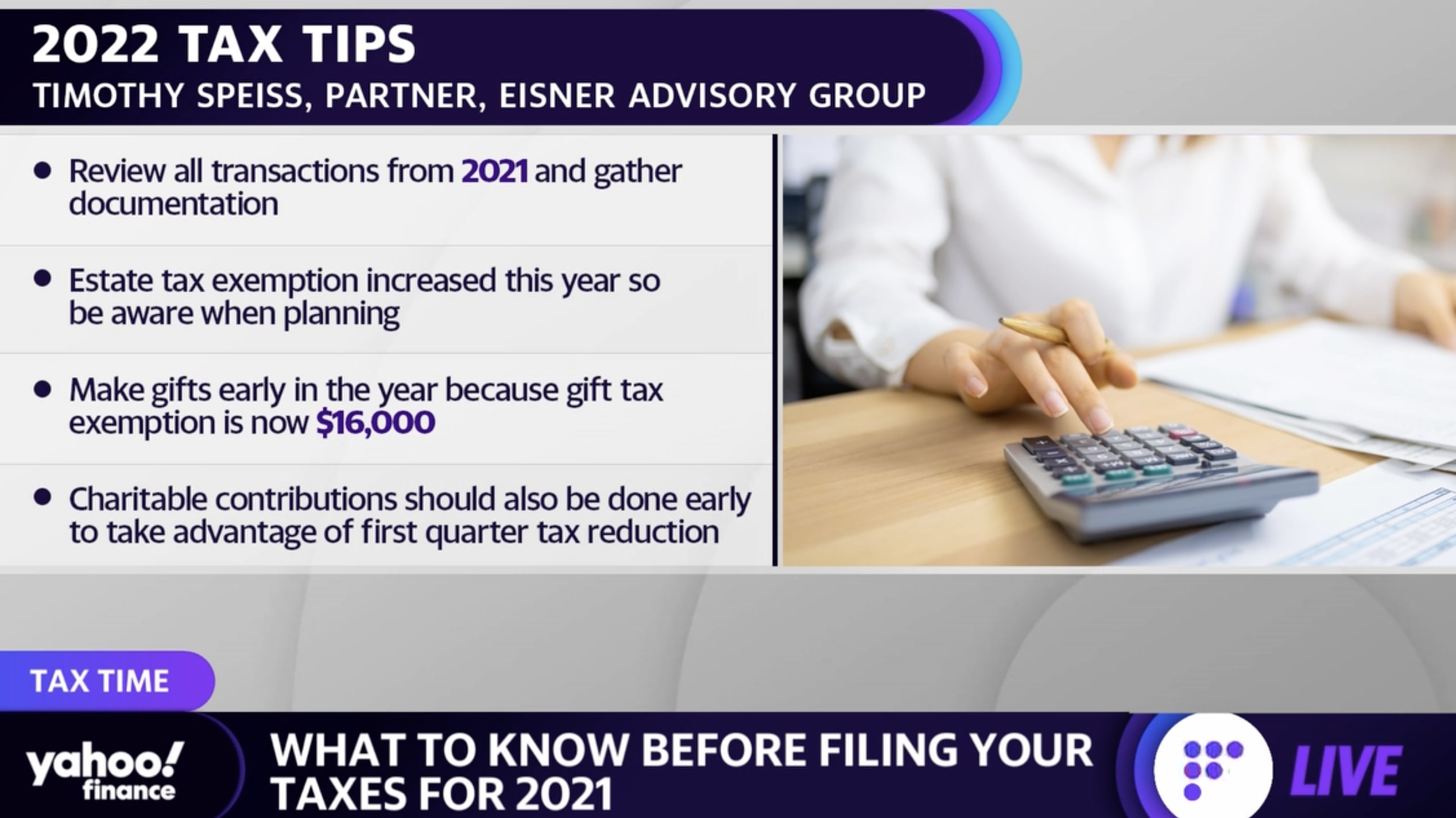

Taxes 7 Tips To Prepare For The 2022 Tax Season

New Estate And Gift Tax Laws For 2022 Youtube

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset